Grantor Lead Trust

Grantor Lead Trust

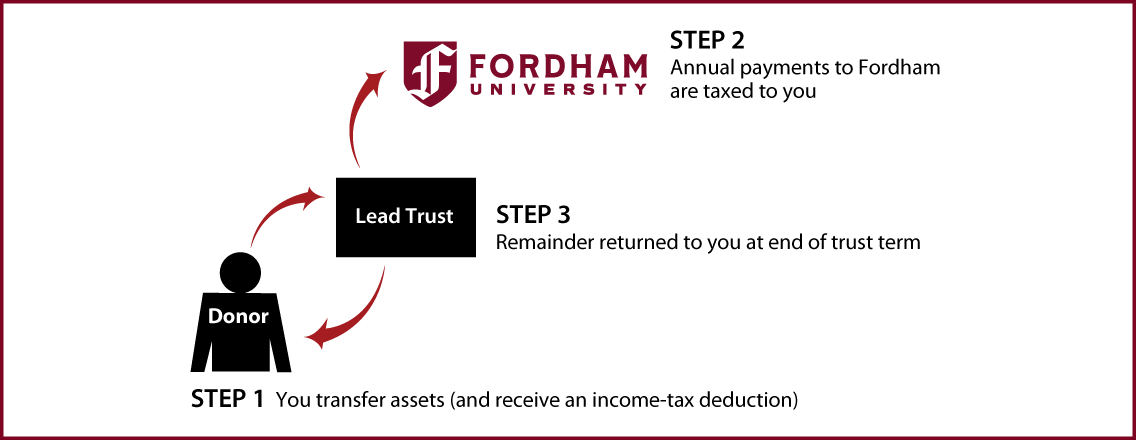

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years), transfer cash or other property to trustee, and receive an income-tax deduction

- Trustee invests and manages trust assets and makes annual payments to Fordham

- Remainder transferred back to you

Benefits

- Annual gift to Fordham

- Property returned to donor at end of trust term

- Professional management of assets during term of trust

- Charitable income-tax deduction, but you are taxed on trust's annual income

Request an eBrochure

Request Calculation

Contact Us

Jackie Comesanas

Executive Director of Gift Planning

(212) 636-7244

jcomesanas@fordham.edu

Fordham University

45 Columbus Avenue, 8th Floor

New York, NY 10023

Tax ID number (EIN): 13-1740451

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer